When starting a business, one of the most crucial decisions entrepreneurs must make is selecting the appropriate business entity. This choice affects everything—from how the business is taxed to how much personal liability the owner assumes. In this comprehensive guide, we’ll explore the business entity meaning, various types, their features, and the importance of choosing the right structure for long-term success.

What is a Business Entity?

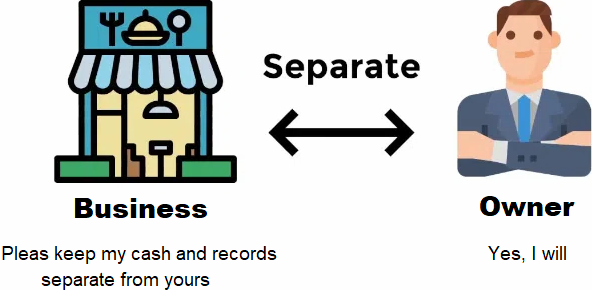

A business entity refers to the legal structure under which a business operates. It defines how a business is organized and determines the legal and tax obligations the business and its owners must fulfill. A business entity can be anything from a sole proprietorship operated by one person to a large multinational corporation with thousands of shareholders.

Understanding the business entity meaning is essential because it influences ownership, liability, taxation, and compliance requirements. Whether you’re launching a small side hustle or planning a scalable startup, the structure you choose will impact your day-to-day operations and long-term strategy.

Types of Business Entities

Choosing the correct business entity involves understanding the different types available and how they align with your business goals. Below are the most common types of business entities:

1. Sole Proprietorship

Features:

- Owned and operated by one individual

- Easiest and least expensive entity to establish

- Owner and business are legally the same

Pros:

- Simple setup and low cost

- Full control for the owner

- Taxed only once (pass-through taxation)

Cons:

- Unlimited personal liability

- Difficulty in raising capital

- Business ends upon owner’s death or decision

2. Partnership

A partnership involves two or more individuals sharing ownership of a business.

Types:

- General Partnership (GP): All partners share responsibilities and liabilities.

- Limited Partnership (LP): Includes general and limited partners, where limited partners have restricted liability.

- Limited Liability Partnership (LLP): All partners have limited liabilities and protection from debts and misconduct of other partners.

Features:

- Shared decision-making

- Agreements typically govern roles and profit-sharing

Pros:

- Easy to form

- Shared financial commitment

- Combined skills and knowledge

Cons:

- Shared liability (except LLP)

- Potential for disputes

- Profit sharing may reduce personal income

3. Limited Liability Company (LLC)

An LLC blends the flexibility of a partnership with the liability protection of a corporation.

Features:

- Separate legal entity from its owners (called members)

- Offers limited liability protection

- Flexible management structure

Pros:

- Limited personal liability

- Pass-through taxation option

- Less paperwork than corporations

Cons:

- Varying rules across states

- Self-employment taxes may apply

- May dissolve upon member’s withdrawal unless otherwise stated

4. Corporation

A corporation is a more complex business entity suitable for businesses seeking investment and growth.

Types:

- C Corporation (C Corp): Separate tax-paying entity

- S Corporation (S Corp): Allows profits/losses to be passed through to shareholders

Features:

- Owned by shareholders

- Managed by a board of directors and executives

- Perpetual existence

Pros:

- Limited liability for shareholders

- Easier to raise capital

- Perpetual life

Cons:

- Double taxation (C Corp)

- Regulatory complexity

- Expensive to establish and maintain

5. Cooperative

A cooperative is a business owned and operated for the benefit of its users or members.

Features:

- Democratic control (one member, one vote)

- Profits shared among members

Pros:

- Member-focused

- Tax advantages

- Equitable profit distribution

Cons:

- Slower decision-making

- Requires active member participation

- Limited profit potential

Key Features of Business Entities

Understanding the business entity meaning goes beyond definitions; it’s about grasping the features that distinguish one form from another. Below are common attributes to consider when choosing an entity:

1. Liability Protection

Some business entities offer limited liability protection, shielding owners’ personal assets from business debts and legal actions. This is especially important for businesses with higher risk or substantial investment.

2. Tax Implications

Each entity type has different tax obligations. For example, sole proprietorships and partnerships offer pass-through taxation, while C corporations face double taxation. Understanding these implications is vital for tax planning and compliance.

3. Regulatory Compliance

Different structures have varying legal and regulatory requirements. Corporations, for instance, are subject to more rigorous rules than LLCs or sole proprietorships. This includes annual reporting, record-keeping, and board meetings.

4. Ownership and Control

The entity type determines who makes decisions and how profits are shared. A sole proprietor has complete control, whereas a corporation’s decisions rest with a board of directors.

5. Capital Raising

Your ability to raise capital is also influenced by your entity choice. Corporations can issue stock to attract investors, while sole proprietors and partnerships might find it harder to secure funding.

Importance of Choosing the Right Business Entity

Choosing the correct structure is foundational to your business’s success. Here’s why understanding the business entity meaning is so important:

1. Risk Management

Some businesses, especially those offering professional services or selling physical products, face considerable legal risks. An LLC or corporation can protect personal assets and minimize financial exposure.

2. Tax Optimization

The wrong entity choice could lead to unnecessary tax liabilities. Choosing the right structure helps you benefit from available deductions, exemptions, and tax rates suited to your income level and business goals.

3. Business Credibility

Entities like LLCs and corporations add a level of professionalism and credibility, which can help attract clients, partners, and investors. A formal structure signals permanence and trustworthiness.

4. Scalability and Growth

If you plan to expand your business, raise investment, or eventually go public, your entity structure will either support or hinder that growth. Corporations, for example, are more conducive to large-scale expansion.

5. Succession Planning

A well-chosen entity facilitates easier transfer of ownership and continuity. Corporations and LLCs often outlast their founders, allowing for smoother transitions.

Business Entity Meaning in Legal Context

From a legal perspective, the business entity meaning implies the rights and responsibilities that come with the structure. It determines the legal identity of the business, who is responsible for its actions, and what happens in the event of a lawsuit or debt.

- Legal Separation: LLCs and corporations are considered distinct legal entities, meaning they can sue or be sued, own property, and enter contracts.

- Legal Liability: The degree to which owners are liable for business debts and obligations varies widely by entity.

- Compliance Requirements: Legal responsibilities also include maintaining proper licenses, filing annual reports, and adhering to employment laws.

How to Choose the Right Business Entity

If you’re wondering how to decide which entity best fits your business, consider the following factors:

1. Nature and Size of the Business

Small businesses with low risk and one owner may benefit from a sole proprietorship. On the other hand, businesses that require external investment or have multiple partners might be better suited as LLCs or corporations.

2. Long-Term Goals

Do you plan to expand, seek investors, or eventually sell your business? These goals influence your choice. Corporations often serve better for scalability and investment.

3. Financial Needs

Your ability to raise funds can be significantly impacted by your entity type. Corporations attract venture capitalists and angel investors more easily due to their structure and transparency.

4. Risk Tolerance

If your business involves high financial or legal risks, consider forming an entity that offers limited liability protection, such as an LLC or corporation.

5. Tax Preferences

Different structures offer various tax treatments. Consulting a tax advisor or accountant can help you choose an entity that minimizes your tax liability while complying with the law.

Business Entity Meaning in Practice: Real-Life Examples

To illustrate the business entity meaning in action, let’s consider a few real-life scenarios:

- Sole Proprietor: Sarah runs a freelance graphic design service from home. She chooses a sole proprietorship for its simplicity and minimal legal requirements.

- LLC: John and Maria start a home renovation business. They form an LLC to protect their personal assets from potential lawsuits and share ownership.

- C Corporation: A group of tech entrepreneurs launches a startup aiming to attract venture capital. They form a C corporation for its investment-friendly structure.

- S Corporation: A small family business incorporates as an S Corp to enjoy the liability protection of a corporation while avoiding double taxation.

Conclusion:

Understanding the business entity meaning is more than a theoretical exercise—it’s a foundational decision with far-reaching implications. The right structure can protect your assets, optimize your taxes, and enable your business to grow efficiently. The wrong one, however, can expose you to risks, increase your tax burden, and limit your future options.

Before launching your venture, take the time to assess your goals, risk tolerance, and operational needs. Consult legal and financial professionals when necessary. The effort you invest in choosing the correct business entity today will pay dividends in peace of mind and sustainable growth tomorrow.